We are Performance Driven, Collaborative, and Entrepreneurial

At Lamont Street Partners, we know that success begins and ends with relationships – both with our investors and our operating partners.

We are hyper focused on transparency, collaboration, and integrity and remain actively involved with our partners throughout the entire life cycle of an investment from origination to asset management to disposition.

A significant differentiator for us is our flat organizational structure and informal communication channels which make us nimble and action-oriented. Beyond functioning as capital partners, we strive to be thought partners who help maximize value through our collective experience and collaborative process.

Target Investment Criteria

Property Types

Multifamily, Student Housing, Industrial, Retail, Office, and some specialty product types.

Investment Structures

Joint venture equity, co-GP capital, preferred equity, mezzanine debt.

Minimum Investment Size

$2.0 million

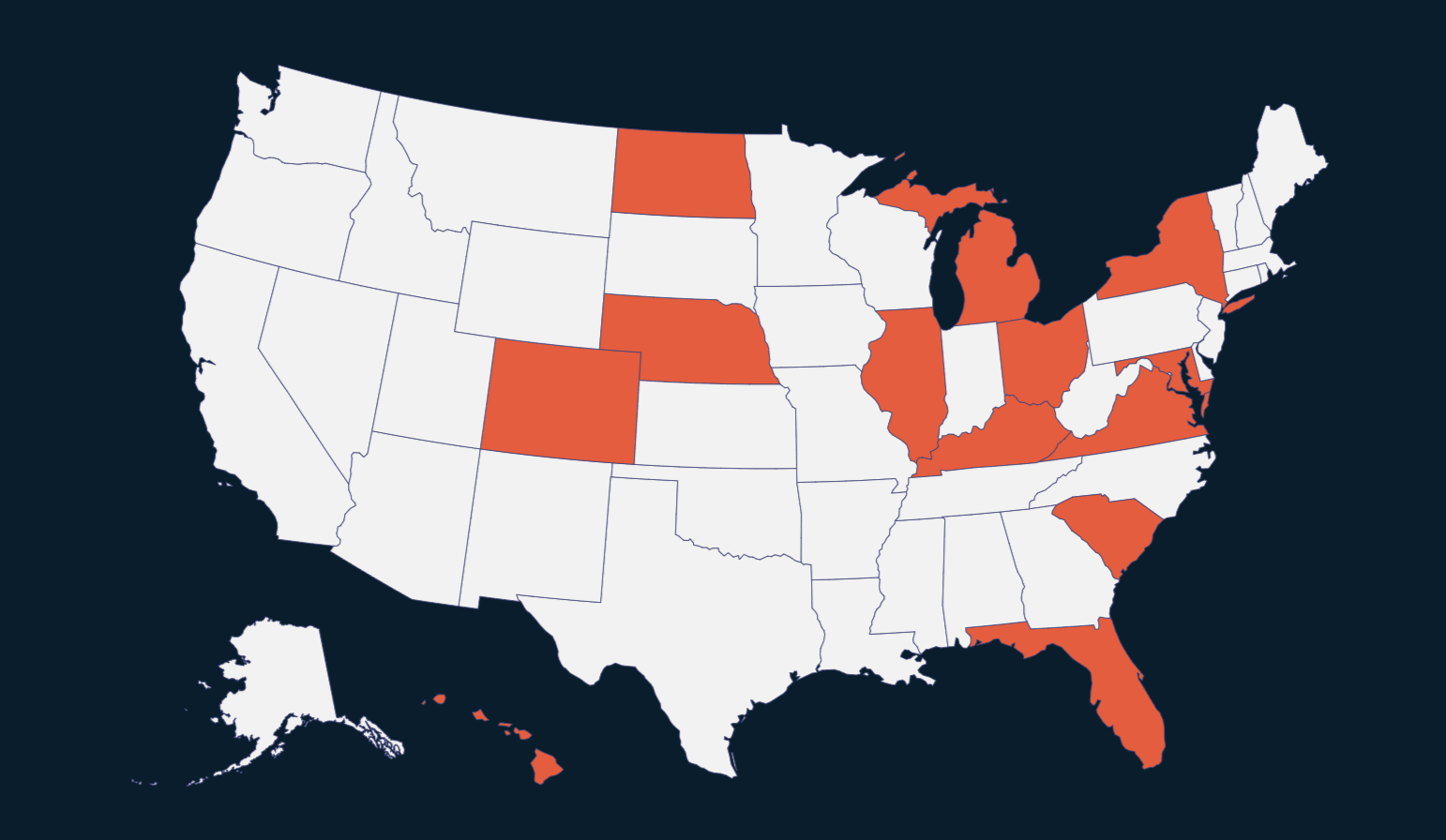

Geography

US Markets

Risk Profile

Value-Add to Opportunistic

Average Hold Period

2-5 Yrs